Despite the lack of official data on the export of rare earth metals by Central Asian countries, an analysis of ore, slag, and ash exports reveals interesting trends. These exports often include critical resources highly sought after by leading global powers, particularly metals such as molybdenum, titanium, and vanadium.

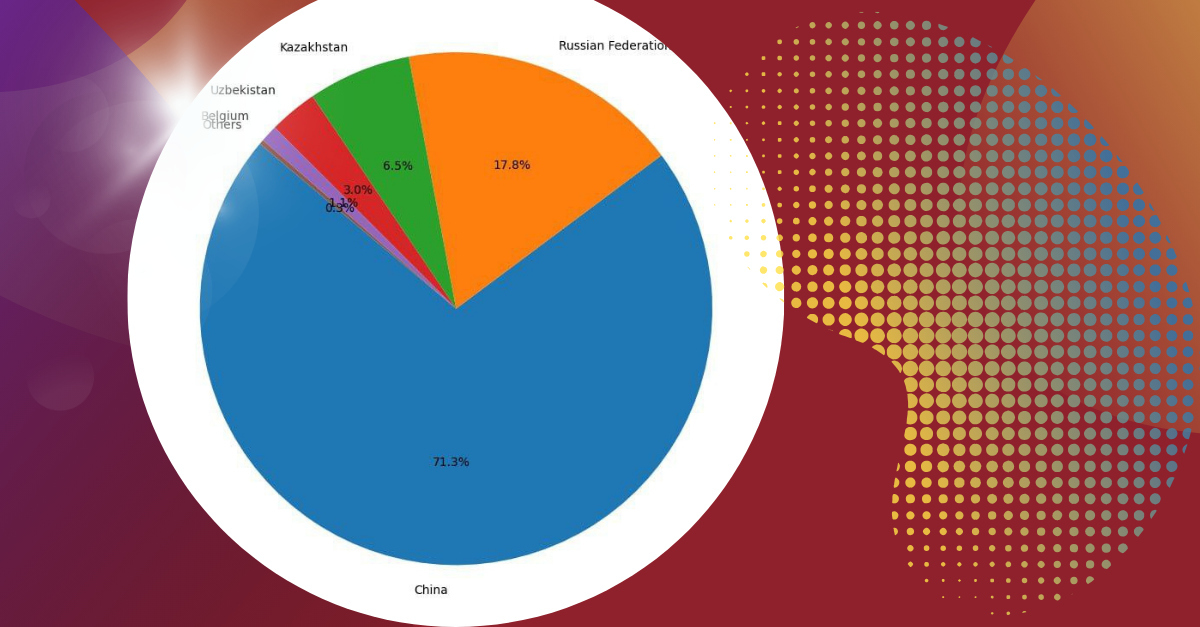

According to Trademap.org data from 2019 to 2023, Central Asian countries exported a wide range of ores and concentrates, including copper, iron, precious metals, zinc, lead, molybdenum, chromium, and niche metals such as niobium and tantalum.

In recent years, the market has also seen the introduction of products such as tin, tungsten, and titanium ores. For example, copper ore exports showed stable growth—from approximately $1.17 million in 2019 to around $3.15 million in 2023. Iron ore peaked at $1.6 million in 2021 before experiencing a decline in export volumes in subsequent years.

One notable trend is the significant increase in molybdenum ore exports, which surged from about $4 million in 2019 to approximately $144 million in 2023. This is a clear reflection of increased global demand and investment.

An analysis of trade with the European Union under the category “26 Ores, Slags, and Ash” shows that molybdenum stands out: its exports increased from around $11 million in 2021 to nearly $60 million in 2023. In this segment, Kazakhstan holds a dominant position, providing nearly the entire cumulative export value, while contributions from other Central Asian countries remain significantly lower.

Central Asian countries’ export portfolios reveal a trend towards transitioning from traditional raw materials such as copper and iron to more valuable niche ores, especially molybdenum. This trend is evident both in the global market and in trade with the European Union, where Kazakhstan acts as a key supplier.

Will the European Union be able to position itself as a key importer of critical metals from Central Asia? The future will tell.